Do Solar Attic Fans Qualify For Energy Credit

Contact us today to find a local dealer in your area.

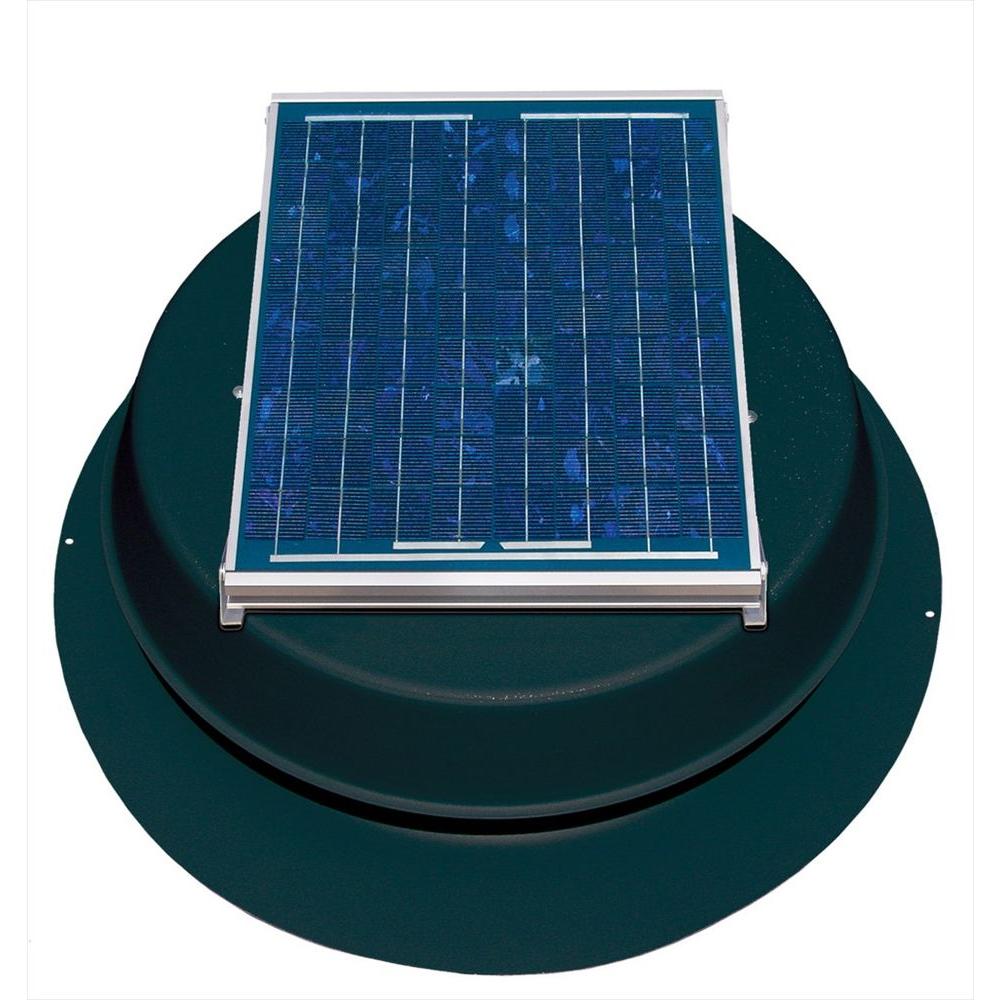

Do solar attic fans qualify for energy credit. Federal tax credits apply to purchase price of the solar attic fan installation costs and the sales tax. Contact us today to find a local dealer in your area. A single fan typically costs 300 to 600 plus an extra 100 to 150 each for installation. With so many ways to save why wait any longer.

The fan must be installed within the period specified by the tax credit typically the year that it is being claimed or a range of years within which the credit is valid. According to the u s. Claiming the credit to claim an energy credit on the basis of a whole house fan installation the fan must meet certain qualifications. Solar star is a hybrid product that is both an exhaust fan and produces electricity.

With so many ways to save why wait any longer. Attic breeze products qualify for federal tax credits as well as state and local incentives in select locations. The irs states in questions 25 and 26 in its q a on tax credits13that off site solar panels or solar panels that are not directly on the taxpayer s home could still qualify for the residential federal solar tax credit under some circumstances. Department of energy you can claim the residential energy efficiency property credit for solar wind and geothermal equipment in both your principal residence and a second home.

Attic breeze products qualify for federal tax credits as well as state and local incentives in select locations. But fuel cell equipment qualifies only if installed in your principal residence. Energy star rated solar attic fans still qualify for a federal tax credit of 30 percent of your purchase and installation costs. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

June 5 2019 10 17 pm the solar attic fan does qualify for the credit called residential energy efficient property and it equals to 30 percent of what a homeowner spends on qualifying property including cost for assembly preparation and installation as well as piping and wiring. In irs notice 2013 70 a clarification was made that specifically excludes portions of solar powered exhaust fans. All solar star attic fans are considered residential photovoltaic systems which means they turn sunlight into energy so a portion of the cost of the fans qualify for a federal income tax credit. But you ll likely need two fans to make an impact says danny.